Nick Dennis always knew that he wanted to make an impact in the fitness world. During his senior year at college, while working toward a math degree, he came up with an idea to help fellow students find a fitness partner on campus. He realized that having a partner was the most effective way for most people to gain the motivation they needed to exercise consistently. That simple idea eventually led to fitDEGREE, Nick’s growing software startup for class-based fitness studios that want a more community-driven way to manage their local business.

Nick first marketed the fitDEGREE app to college recreation centers, and it only consisted of registration and inventory control features. Eventually, as Nick described it, the fitness and health studio industry found him, and his app quickly became more popular. Nick realized that adding payments to the software product was the only way he could continue to compete in the space, so he took the opportunity.

Nick considered partnering with an ISO, but was reluctant to hand off his studio owners — and the relationships he built with them — to a payment processor.

I work with small, local business owners. These are people who value their family as much as they value owning a business. When it comes to their tech stack, they want one point of contact. Handing them off creates friction they don’t need, or want.

Nick Dennis | fitDEGREE

Becoming a full-fledged payment facilitator wasn’t the right fit either. “It’s too much work,” Nick said. “Payments is a core part of my business, and a core part of our offering, but I’m not a payments company. I’m a studio management company. I didn’t want the liability issues either.”

Payrix Pro — In a Class of its Own

Nick found the hybrid approach he wanted with Payrix Pro. Its PayFac-as-a-Service solution enabled Nick to control the onboarding and customer service, while Worldpay for Platforms managed the processing, compliance, and most of the risk and liability.

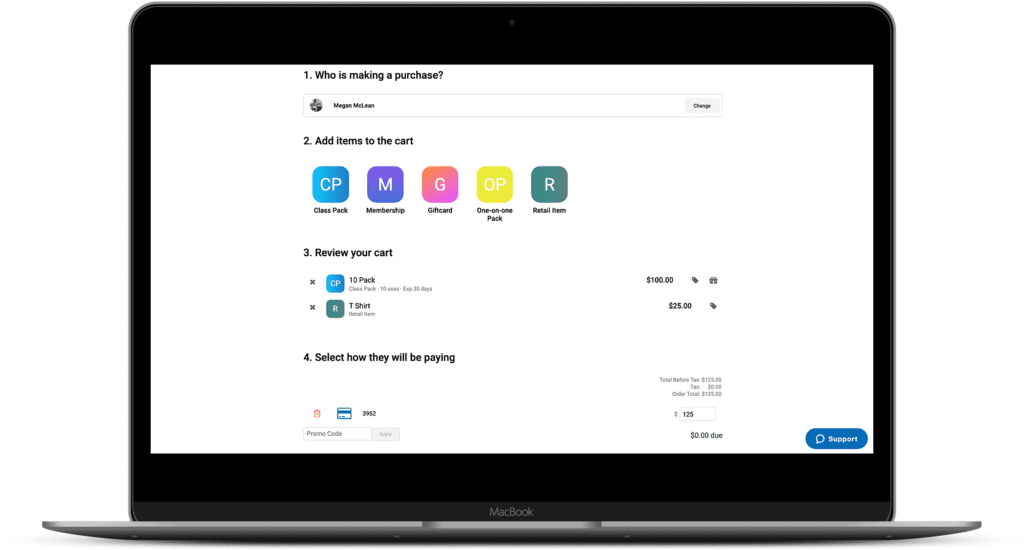

The seamless integration created a smooth payments experience for fitDEGREE end users, whether they were using the fitDEGREE app, website widget, branded app, or the admin website.

“For the first time, our clients are telling us that they didn’t have to do any nurturing of customers,” Nick said. “They simply buy the intro offer on the website or app, come to class, then show up the next week with a membership already purchased... that self-service style platform is huge.”

Perhaps the biggest differentiator that Payrix Pro offered fitDEGREE was a robust admin dashboard. Nick gets offers all the time from embedded payment vendors, but he declines them because they lack that essential feature. “The admin dashboard allows us to support our clients in many ways. With software, bugs happen all the time, and the best thing we can see is a display error. When something happens on the payments side, I can go into my client’s merchant history and view all their transactions and withdrawals to resolve the issue, without having to contact support.”

Maintaining control over the customer experience is also crucial to the fitDEGREE brand. As a small company helping other small companies, if fitDEGREE were to hand over their customers to a big corporation, their customers wouldn’t be able to relate.

“Staying connected to your industry is important. I’d probably lose deals if I was wearing a suit and my Zoom background was a stuffy office. They want to see me in my house, with my pets, and in a hoodie. It’s relatable.”

Fees and transparent pricing were also an important factor for choosing Payrix Pro. Nick said other payments companies he talked to have absurd fees that he couldn’t afford to absorb or pass on to his clients — he didn’t want them to feel nickel-and-dimed.

“Our clients enjoy getting their money as quickly as possible. They process a payment on Monday, and they get their money on Wednesday. If I want it that fast with other companies, I’d be charged a fee.”

Healthier Profits

fitDEGREE is on track to process around $10 million in payments this year. “Right now, the revenue share with Worldpay for Platforms can pay for a full-time employee,” Nick explained. “But we only have a part-timer who spends around 10 hours a week servicing 175 clients. Using Payrix Pro is a profitable operation for us that fits nicely into a scaled financial model.”

Nick added, “Our average monthly revenue per client was about $145 before Payrix Pro. Now it’s at about $175 with our revenue share deal — all without raising client prices, and keeping an incredibly competitive payment processing rate.”

What we have feels like it can easily scale to 1,000 to 5,000, and even up to 10,000 clients. If it weren’t for disputes, I would call Payrix Pro passive income. We had to learn a bit more about payments than I initially expected, but it has certainly paid off.

Nick Dennis | fitDEGREE

Payment experiences designed to help you outsprint the competition.

Get powerful payments technology that delivers the exact look and feel you want.