GROw | text-to-pay

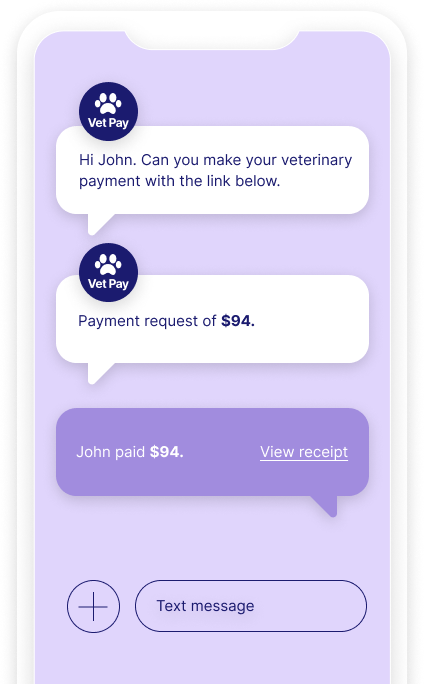

Powerfully fast payment collection with Text-to-Pay

Transform transactions into convenient interactions with Text-to-Pay. Easily send payment requests to customers via SMS, making it simple for them to pay instantly. By streamlining payment collection, you can turn this process into one of your platform’s most valued and appreciated payment solutions.

Trusted by hundreds of thousands of merchants using software partners like

From invoice to income in minutes

Easily integrate our intuitive Text-to-Pay tools into your platform, empowering your merchants to get paid faster and keep their customers coming back.

Increase speed-to-payment and lower operational costs with Text-to-Pay

Meet modern payment preferences. Accelerate and automate billing and payment collection with one seamless solution built to scale with you.

A more modern experience

Real-time engagement with simple and secure billing and payments via text.

Faster payments

Receive prompt, timely payments that accelerate cash flow and improve revenue cycle management.

Automate and scale

Automate billing and payment collection while reducing organizational costs (labor, etc.).

Leverage sophisticated infrastructure

Text-to-Pay is fully integrated into the Worldpay ecosystem, including onboarding and support.

Data reveals merchants across industries get paid faster with Text-to-Pay

Text-to-Pay isn’t just another payment option, it’s a competitive advantage that streamlines your merchants' operations and strengthens their customer relationships. See how simply adding Text-to-Pay is transforming payment times across industries:

- Healthcare: Average payment time drops from 49 days with traditional paper invoices to just 3 days with Text-to-Pay. (Source)

- Field Services: Nearly half (47%) of all Text-to-Pay invoices are paid within 5 minutes. Compared to one study that stated the average invoice payment time for a contractor after job completion is 51.63 days. (Source)

- Automotive: 97% of Text-to-Pay invoices are paid within 24 hours. According to Forbes, the average privately held company has average accounts receivables days ranging from 35-40 days, with some auto companies being among the highest. (Source)

These are just a few examples of the impact of Text-to-Pay integration. Want to know the impact on you and your industry?

Enable payments and financial technology to help your platform grow.

Explore products that elevate customer loyalty.

Here for you and your merchants, every step (text) of the way.

We offer ongoing support and ready-to-use resources to ensure your merchants and their customers get the most from Text-to-Pay.

- Marketing playbook: Strategic guide and best practices for launching and promoting Text-to-Pay, including audience insights and campaign frameworks.

- Sale materials: A quick reference one pager, a comprehensive guide and a detailed infographic complete with fast facts and visual insights to educate your merchants.

- Communications kit: Ready-to-use social posts, email templates, and messaging scripts to inform your merchants.

- Consumer marketing kit: Downloadable marketing materials for your merchants to share with their customers, including recommended social posts, customer-facing emails, and demo videos.

More Text-to-Pay insights and resources

Text-to-Pay and more designed for your platform

Fill out the form and a sales rep will reach out with more information. If you’re already a partner and interested specifically in our Text-to-Pay solution, reach out to your Worldpay Relationship Manager.