Embedded Payments: A game changer for software providers

It’s time to grow your software user base, engage current customers, and remain competitive in the marketplace. Welcome to the world of Embedded Payments.

Trusted by industry-leading software solutions

The 4 software platform non-negotiables

Payments acceptance

Customers want access to the payment types that make the most sense for their business and their consumers—recurring payments, mobile acceptance, 24-hour card settlements, etc.

User experience

Adding payments onto your platform haphazardly isn’t enough to move the needle. Frictionless payments experience in a trusted and well-supported platform can.

Value-added services

The top software companies are exploring Embedded Finance integrations to stay relevant, agile, and in demand for their customers.

Security

Business owners want a SaaS provider that instantly elevates their security from a software and payments standpoint.

Discover how software companies use Embedded Payments to meet their goals

Grow software user base and drive revenue

Keep and engage customers with the tools they need

Remain competitive and strategize long-term success

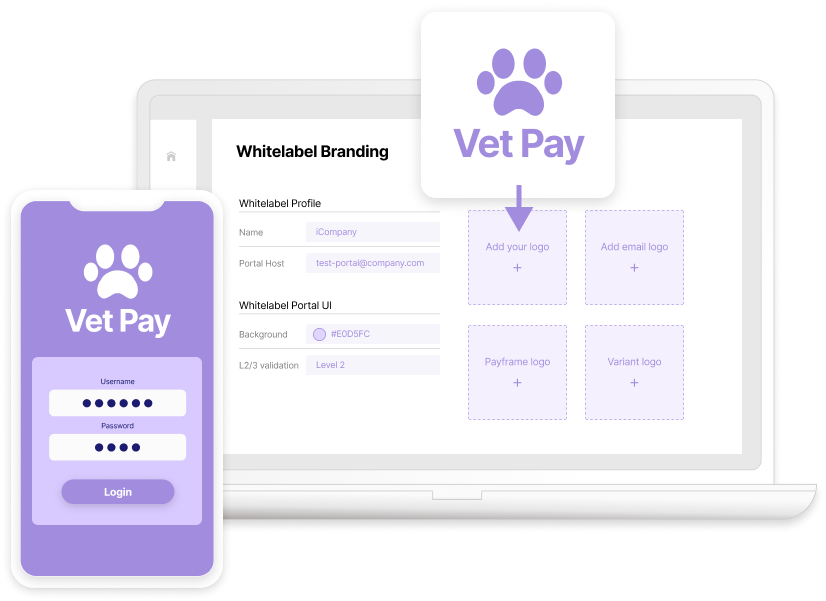

Deliver a branded payment experience

Make payments easier to reconcile with omnichannel options.

One in five businesses stated they would switch software providers to accept all the payment types their customers want.

This shift is driven by two things: changing technology and consumer preferences. And once the wheels start turning, there’s no going back. Providing a unified payments experience is changing the game.

80%

of business owners report that accepting multiple payment types is vital

Explore Embedded Payment possibilities from Worldpay for Platforms.

264%

ROI after moving from prior payments solution

2-3x

higher potential margin

20-50%

less fraud & nonpayment

40%

faster deployment solution

What’s possible with an Embedded Payments partnership?

- Select the Embedded Payments model that makes the most sense for your business goals—Referral Payments, PayFac-as-a-Service, and PayFac.

- Launch a payments offering your customers won’t be able to live without with dedicated support from solutions consultants who will create a personalized implementation plan and tailored payments strategy for you to ensure success.

- Feel secure and confident with sophisticated risk management to safeguard your business and your customers’ business.

- Maximize profitability with pricing strategy guidance from payments veterans.

- Take advantage of a seamless, white-labeled payments experience that is designed to drive user adoption and revenue.

- Access value-added services and a suite of finance products; gift card solutions, PCI compliance programs, omnitoken, working capital, and mobile integrations.

- Stronger customer relationships, business growth, and competitive edge.

Why Embedded Payments in the platform are key

Real impact you can feel across your entire business model

For your software

- An out-of-the-box solution for creating a frictionless payments experience.

- Control over the entire experience from configurable fees to a white-labeled portal.

- White glove support and expert guidance to scale with your business.

For your customers

- The merging of online and offline payments in a single portal for easier management and reconciliation.

- A variety of payment tools that make running and managing a business easier.

- Advanced payment security and risk mitigation technology for protecting sensitive payment data.

For the end consumer

- Fast and frictionless payment experience.

- Choice of payment method.

- Secure transactions.